| Startup | Website | Country | Product |

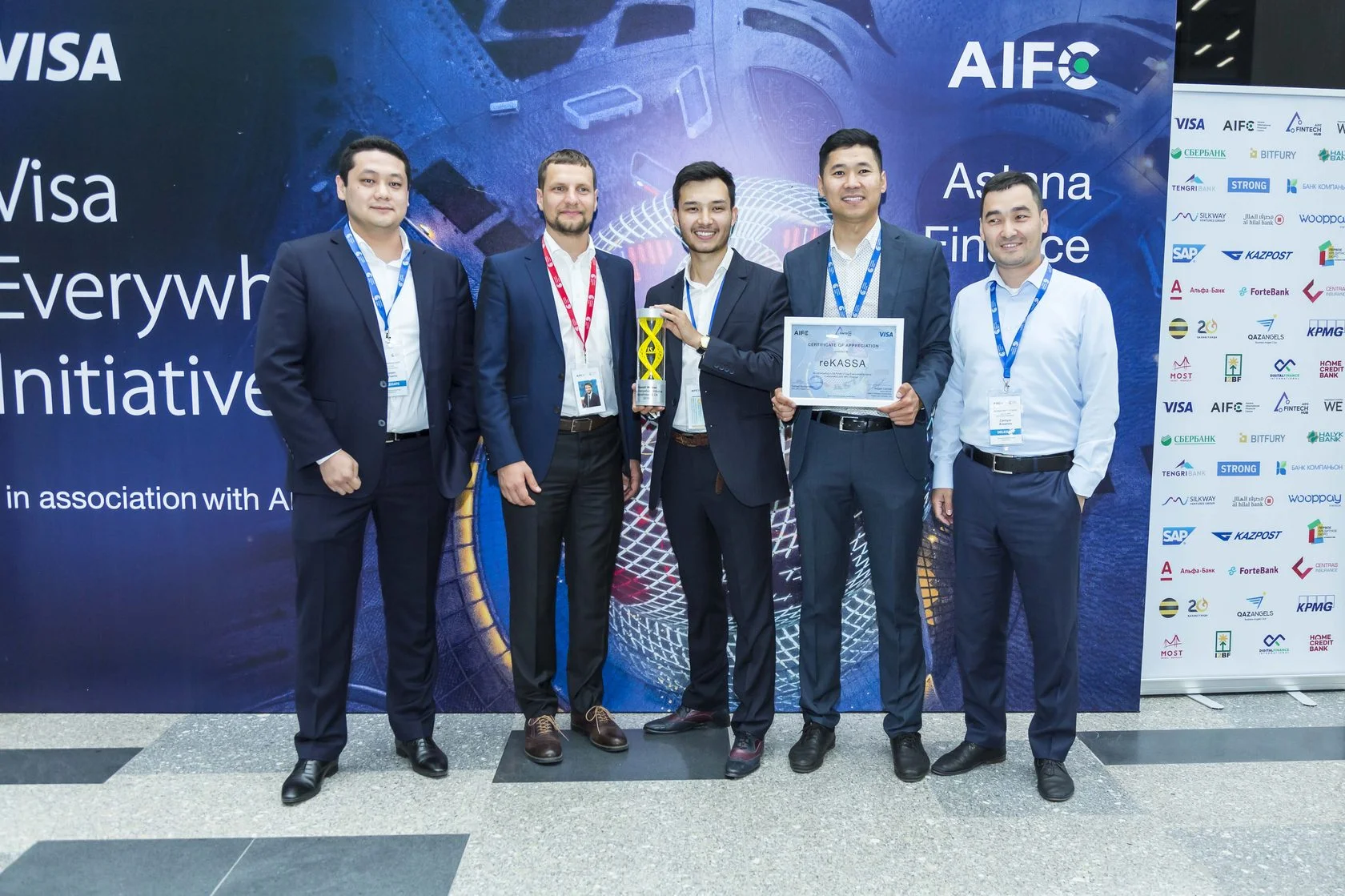

| reKASSA | www.rekassa.kz | Kazakhstan | reKASSA – this is a free mobile application - a cash register that allows micro-business owners to save 60 thousand tenge |

| NambaPay | nambapay.online | Kyrgyzstan | A mobile application impoverishing various payment methods and an integrated loyalty program |

| LendingStar | LendingStar.com | Singapore | LendingStar - financial platform where SME can sell its receivables and receive low-cost financing for its operations |

| Nebank.kz | nebank.kz | Kazakhstan | Nebank – it is an aggregator of consumer lending and a service for selling goods on credit for offline and online stores, retailers and retail chains |

| MARTA | marta.uz | Uzbekistan | Mobile acquiring for EMV cards with MPOS card readers |

|

|

|

|

|

|

|

Projects at the idea / prototype stage

|

Projects ready for implementation

|

|

|

|

Financial literacy

|

Financial services for individuals

|

Financial services for SMEs

|

|

Insurtech

|

B2B services for financial sector

|

Mobile Finance Services for Beeline

|

|

Challenge 1: Services that allow adults, children and teenagers to explore financial services and manage personal finances.

|

|

|

Detailed information

Financial literacy is a combination of knowledge and skills in the field of human financial behavior, leading to improved well-being and quality of life, ability and confidence in managing personal finances and long-term financial planning.

For this challenge, we are looking for innovative solutions that will help people with these issues:

|

|

|

Useful links for preparation:

|

|

|

Challenge 2: Services that simplify access to loans, money transfers and payments, allowing to compare financial services, providing new level of convenience, speed and consumer experience.

|

|

|

Detailed information

For this challenge we are looking for projects, services and mobile applications that are directed to individuals and customers

Examples of possible directions of current challenge:

|

|

|

Challenge 3:

Financial services for SMEs

Technological solutions that allow companies from different business areas and of different sizes to accept cashless payments, use loyalty systems, personalize relationships with customers.

|

|

|

Detailed information As part of this challenge, we are looking for any services that make the work of small and medium size businesses more efficient through the introduction of innovative financial solutions and technologies for personalizing customer relationships.

|

|

|

Challenge 4: Technologies that drastically change insurance: online transfer of policies, use of the blockchain, automated underwriting, artificial intelligence, telematics, personalized insurance.

|

|

|

Detailed information As part of this task, we are looking for services that will change the insurance market, make it cheaper and more popular among customers.

Examples of directions for developing ideas:

|

|

|

Challenge 5: Services and systems that allow to improve work and internal processes in banks and financial sector companies

|

|

|

Detailed information As part of this task, we are looking for services and systems that allow us to improve work and internal processes in banks and financial sector companies.

Examples of directions for developing ideas:

|

|

|

Challenge 6: Financial services integrated with mobile operator Beeline

|

|

|

Detailed information Beeline is looking for teams that can implement the following services:

1. A prototype of a virtual bank issuing virtual bank cards Visa Beeline, issuing microloans 2. Tools for making payments from the mobile balance in trade and service enterprises 3. Platform (application) for transfers from the balance to the balance of a mobile phone within one operator and to / from other operators with verification of the sender and receiver by means of biometrics 4. Platform for creating and managing a coalition bonus program with trade and service enterprises with payment for services from a mobile phone balance via a QR code and a Visa Beeline card |

|

|

Round 1. March 13 - April 30 |

Submission and reviewing of applications, online interview with teams.

|

|

Selection of best teams May 1 - May 10 |

Selection of best teams to participate in the Semifinal in Astana. Up to 40 teams will be selected for participation.

|

|

Round 2. May 23-24 |

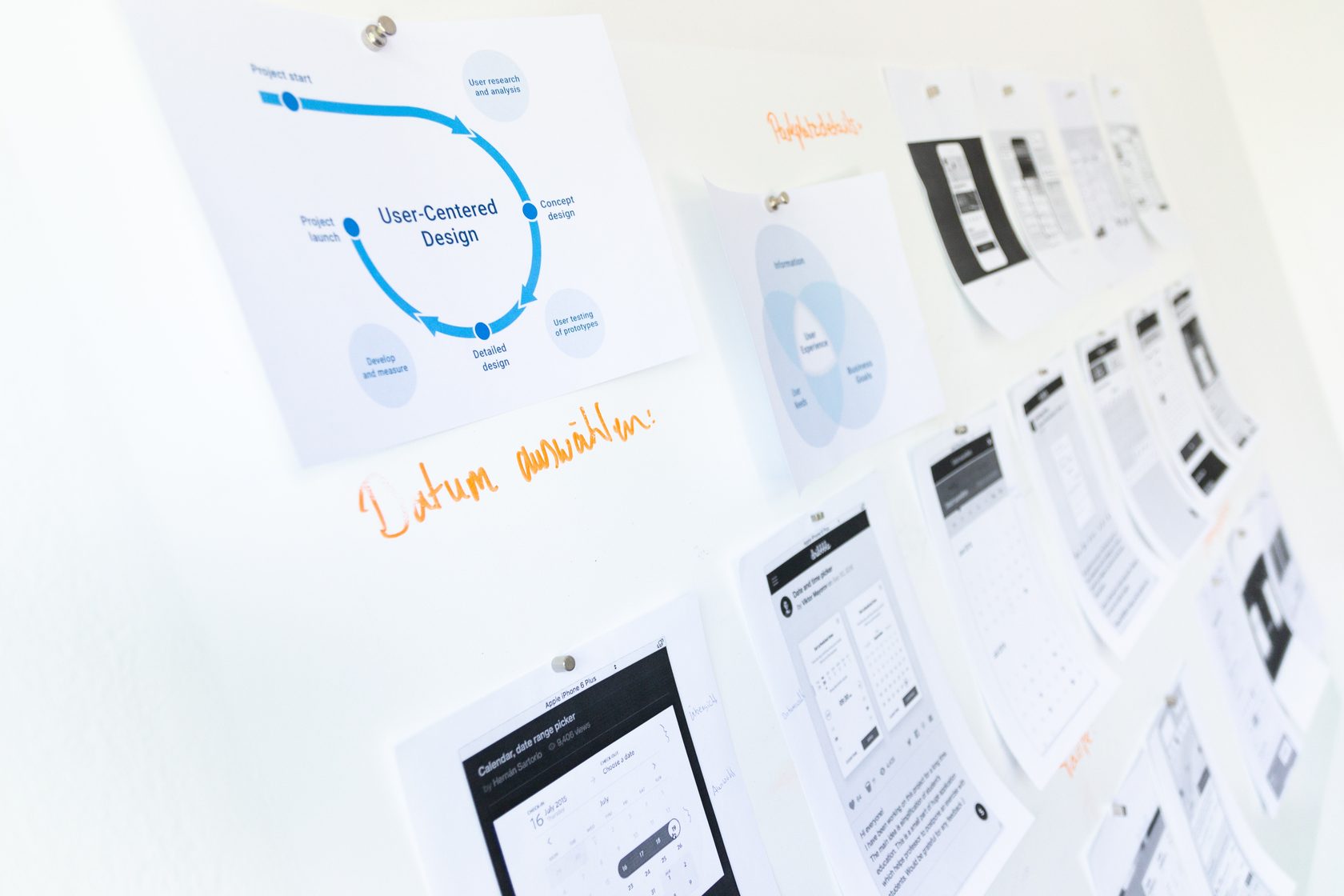

2-day Bootcamp, when teams will work with mentors to finalize their ideas and products. Presentation of projects in front of jury. Winners will continue to work on the project in Round 3. |

|

Round 3. June 1 - July 31 |

During the program, teams will implement their ideas along with the best mentors and consultants from the financial industry. The program will be held at the AIFC Fintech Hub in Astana.

|

|

Final July 2-4 |

Within the framework of the Astana Finance Days conference, a Demo day will be held, when all participants of the 3rd round will be able to present their projects to Visa, the Fintech community, bankers, investors and partners.

|

| |

|

|

|

| |

|

|

|

|

|

Yevgen Lisnyak

|

Taras Volobuiev

|

Ivan Istomin

|

|

Senior Director, Head of Strategic Partnerships, Fintech and Ventures Visa |

Chief Startup Officer AIFC Tech Hub |

Managing Director of Retail Business Alfa Bank Kazakhstan |

|

Rashid Dusembaev

|

Zhanargul Izimova

|

Sergey Koptik

|

|

Managing Director Centras Insurance |

Managing Director of Retail Business Sberbank Kazakhstan |

Head of Mobile Financial Services Beeline Kazakhstan |

|

Andrey Rudov

|

Aleksander Bondarenko

|

Vitaly Kim |

|

Head of Card Business Home Credit Bank Kazakhstan |

Director Wooppay |

Head of Innovation Projects Halyk Bank |

|

Bolat Mynbayev

|

Alim Khamitov

|

Alexander Trapezin

|

|

Head of Strategy and Operations Group KPMG in Kazakhstan and Central Asia |

PhD, Entrepreneur, Director Business-incubator MOST |

CIO Tengri Bank |

|

|

|

Explore Visa' s APIs on the Visa Developer Platform to integrate into your product

|

Check out this video of past pitches to see how to present your ideas

|

| Visa Developer Center > | See on YouTube > |